Phone Number of

Service Tax Delhi is

1800 425 4251 .

The Commission rate of Service tax was created on 15th September 2004 merging the jurisdictions of Central Excise Commissionerates of Delhi-I, Delhi-II, Gurgaon and Faridabad. The service tax is imposed on the services and is collected by Central Board of Excise and Customs.

Customer Contacts Of Service Tax Delhi

Toll-Free Valuable Contact Number for General SupportPhone:

1800 425 4251Contact Number of Service Tex Delhi First Head QuartersPhone:

24366840Contact Number of Service Tex Delhi 2nd Head QuartersPhone:

24366212Additional Contact Numbers of Service Tex DelhiPhone:

95124-2346331 / 95129-2267826E-mail:

aces.servicedesk@icegate.gov.in Note Timing:

Monday to Friday between 9 AM and 7 PMSaturdays from 9 AM to 2.30 PMService tax was unveiled for the initial time in the year 1994 through insertion of Chapter V of Finance Act, 1994. Service Tax as per section 66, was payable on rendering of services specified in section 65. The Finance Act, 2012 has completely changed the basis of imposing the tax. The tax is payable on all the activities except those specified in negative list or or else exempt. The new taxable services contain mining, asset management and designing. The record of taxed solutions has been extended in every Fund Act. Since then impose of assistance tax on some of the solutions like leasing of immovable residence, on experts like Chartered Accounting firms, Price Accounting firms, Selling of assumption by builder/developer, etc.

E-Form Of Service Tax Delhi

Service Tax Delhi provide every kind of assistance to the esteemed citizens of the country, guiding at every step to spread civic awareness among the masses. The office provide online forms to citizens that aids in filing the taxes.To download forms relating to the allied aspects of service tax do follow the link:

http://www.cbec.gov.in/htdocs-servicetax/st-forms-home E-Payment facility Offer By Service Tax India

Service Tax department Strives towards the timely collection of the service tax implemented as per the bar set by the government. The department has devised various means to provide assistance to the citizens to file the payment of their service tax online. The online facility is more convenient to the individuals who are surrounded by a bust schedule of work. To know more about the online payment services do visit the link:

https://www.aces.gov.in/ePayment.jsp

Service Tax Delhi Address

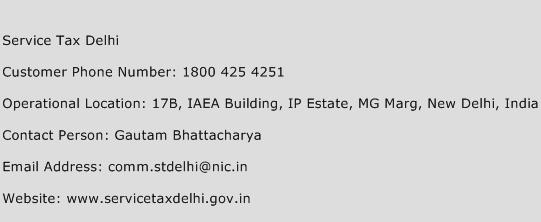

The address of Service Tax Delhi is 17B, IAEA Building, IP Estate, MG Marg, New Delhi, India.

Service Tax Delhi Email Address

The email address of Service Tax Delhi is

comm.stdelhi@nic.in.

Service Tax Delhi Website

The Website of Service Tax Delhi is

www.aces.gov.in.

Service Tax Delhi contact person

The contact person of Service Tax Delhi is Gautam Bhattacharya.

Service Tax Delhi Customer Support Service Phone Number

The customer support phone number of Service Tax Delhi is

1800 425 4251 (Click phone number to call).

Sponsered Ads

The postal and

official address, email address and

phone number (

helpline) of

Service Tax Delhi Service Center and

Service Tax Delhi customer care number is given below. The

helpline of Service Tax Delhi customer care number may or may not be

toll free.

Click Here To View Service Tax Delhi Customer Care Numbers

What was the response after calling on specified numbers? To Write Click Here

If the contact information is incorrect, please let us know Here

Sponsered Ads

View Contact Detail Like Phone Numbers