Phone Number of

Income Tax India Delhi is

011-23413317 / 1800 4250 0025 .

An Income tax is a tax levied on the income of businesses. The

Income Tax Settlement Percentage is an important Different Conflicts Quality procedure for solving tax disputes with regards to Immediate Taxation. At the moment, four seats of the Agreement Percentage are functional at New Delhi, Mumbai, Kolkata and Chennai, respectively. Earnings tax is a tax due, at the amount unveiled by the Partnership Price range for every Evaluation Season, on the Complete Earnings gained in the Past Season by every Person.

E-Filling Contacts of Income Tax India Delhi

For information regarding E-Filling of

Income Tax Return, customers can get through by calling on the given contacts:

Telephone:

1800 4250 0025Telephone:

+91 - 80-2650 0025Working Hours: Monday - Friday, 09:00AM to 08:00PM

Refund Service Contact Of Income Tax India Delhi

To know about the refund service of

Income Tax, customers can contact to the officials at:

Telephone:

1800 425 2229TDS Centralized Processing Center Contacts Of Income Tax India Delhi

In order to get keep in touch with TDS Centralized Processing Center of

Income Tax for any kind for assistance can connect through the below mentioned contacts:

Telephone:

1800 103 0344Telephone:

+91-120-4814600Email:

contactus@tdscpc.gov.inPAN and TAN Contact of Income Tax India Delhi

For information regarding PAN and TAN updation, customers need to call at:

Telephone:

+91 20 2721 8080Tax Return Preparer Scheme contacts Of Income Tax India Delhi

For details regarding Tax Return Preparer Scheme Of

Income Tax India Delhi, consumers can contact to the officials through the given contacts:

Telephone:

1800 102 3738Email:

helpdesk@trpscheme.com

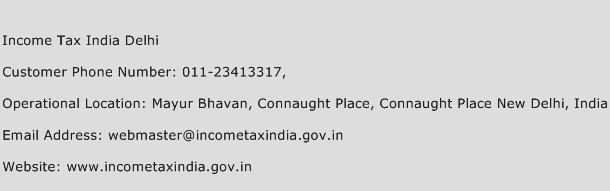

Income Tax India Delhi Address

The address of Income Tax India Delhi is Mayur Bhavan, Connaught Place, Connaught Place New Delhi, India.

Income Tax India Delhi Email Address

The email address of Income Tax India Delhi is

webmaster@incometaxindia.gov.in.

Income Tax India Delhi Website

The Website of Income Tax India Delhi is

www.incometaxindia.gov.in.

Income Tax India Delhi Customer Support Service Phone Number

The customer support phone number of Income Tax India Delhi is

011-23413317 / 1800 4250 0025 (Click phone number to call).

Sponsered Ads

The postal and

official address, email address and

phone number (

helpline) of

Income Tax India Delhi Service Center and

Income Tax India Delhi customer care number is given below. The

helpline of Income Tax India Delhi customer care number may or may not be

toll free.

Click Here To View Income Tax India Delhi Customer Care Numbers

What was the response after calling on specified numbers? To Write Click Here

If the contact information is incorrect, please let us know Here

Sponsered Ads

View Contact Detail Like Phone Numbers