Phone Number of

IRS Injured Spouse is

1-800-829-1040 .

IRS Injured spouse is a branch of Treasury and the

globes extreme brilliant tax administrator.

IRS corporation has been

accumulated near about 2.5 trillion in production and worked above 237 million tax recur. The mission of IRS company is to deliver taxpayer of America high

standard by assisting and complete their tax accountability. IRS is commonly known as

Internal Revenue Service that is the productivity amenity of the USA government. The

initial income tax has been evaluated in the year of 1862, to increase funds for the

Civil War of America. currently the IRS corporation accumulates near about 2.4 trillion tax annually. IRS industry proceeds approximately 234 million recur yearly.

Mission Of IRS Injured spouse

- The goal of IRS Injured spouse corporation is to offer taxpayers leading standard amenity to the residents of Americans.

- The objective of IRS company explains their character as well as public desires regarding participating their role.

- The congress passes tax and need taxpayers to adhere.

- The taxpayers character is to complete their tax responsibility.

Other Contact Numbers Of IRS Injured spouse

Tax Help Line for Individuals, Tel:

(800) 829-1040 Business and Specialty Tax Line, Tel:

(800) 829-4933 Practitioner Priority Service, Tel:

(866) 860-4259 Refund Hotline, Tel:

(800) 829-1954 Forms and Publications, Tel:

(800) 829-3676 National Taxpayer Advocate Help Line, Tel:

(877) 777-4778 Device for the Deaf, Tel:

(800) 829-4059 Social Media Networking Sites Of IRS Injured Spouse

LinkedIn Page Of IRS Injured Spouse https://www.linkedin.com/company/internal-revenue-service

Facebook Page Of IRS Injured Spouse https://www.facebook.com/IRS/info?tab=page_info

Twitter Page Of IRS Injured Spouse https://twitter.com/irsnews

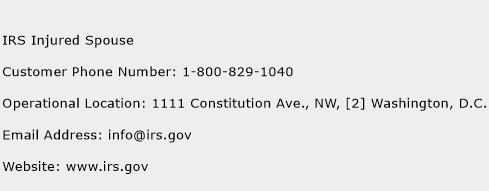

IRS Injured Spouse Address

The address of IRS Injured Spouse is 1111 Constitution Ave., NW, [2] Washington, D.C..

IRS Injured Spouse Email Address

The email address of IRS Injured Spouse is

info@irs.gov.

IRS Injured Spouse Website

The Website of IRS Injured Spouse is

www.irs.gov.

IRS Injured Spouse Customer Support Service Phone Number

The customer support phone number of IRS Injured Spouse is

1-800-829-1040 (Click phone number to call).

Sponsered Ads

The postal and

official address, email address and

phone number (

helpline) of

IRS Injured Spouse Service Center and

IRS Injured Spouse customer service phone number is given below. The

helpline of IRS Injured Spouse customer service phone number may or may not be

toll free.

Click Here To View IRS Injured Spouse Customer Service Phone Numbers

What was the response after calling on specified numbers? To Write Click Here

If the contact information is incorrect, please let us know Here

Sponsered Ads

View Contact Detail Like Phone Numbers